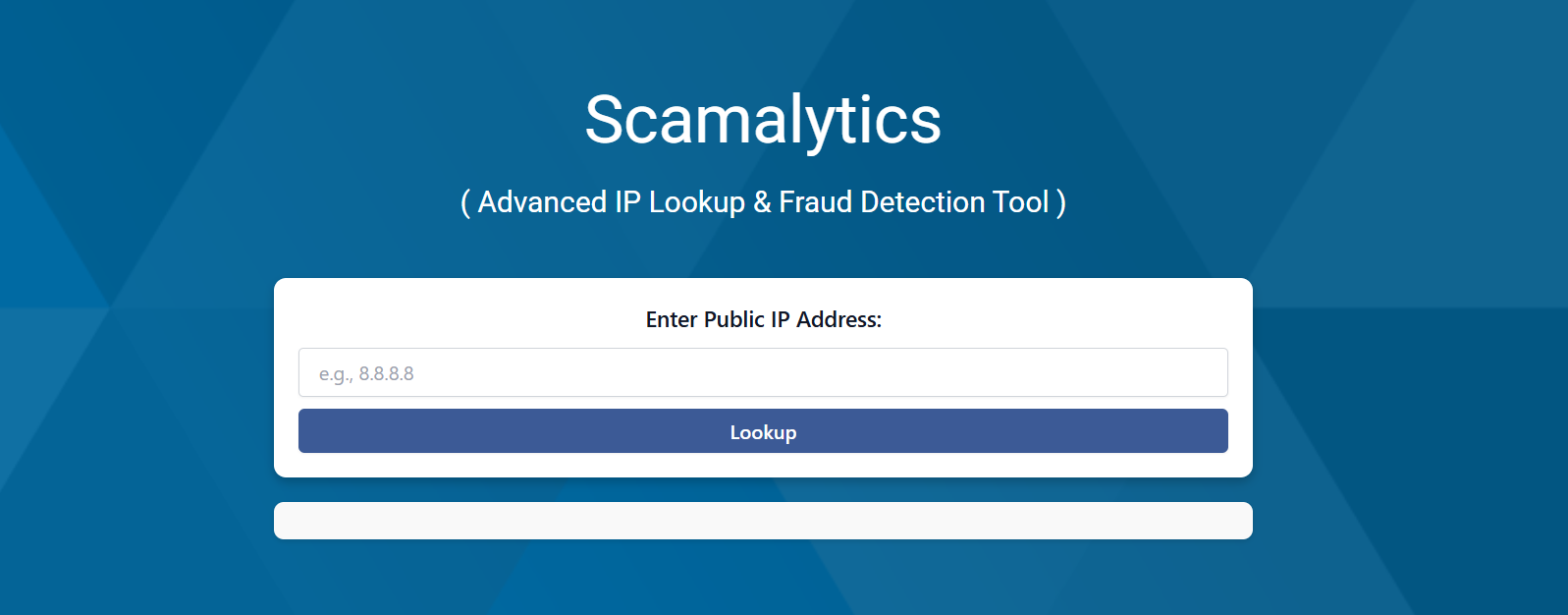

Online scams are a growing concern for businesses, especially those handling sensitive transactions or user data. Fraudsters employ sophisticated techniques to conceal their identities, making detection particularly challenging. This is where Scamalytics comes in, offering robust IP fraud detection and risk prevention solutions.

Scamalytics combines real-time monitoring, risk scoring, blacklists, and machine learning to identify suspicious activity before it causes harm. Its technology is trusted by industries like banking, e-commerce, dating platforms, and online marketplaces. The system operates silently in the background, ensuring threats are addressed without disrupting legitimate operations.

To determine whether Scamalytics can effectively prevent online scams, we must evaluate its detection methods and prevention strategies. Let’s explore how its technology identifies, blocks, and deters scammers across industries.

Real-Time Scam Detection

Identifying Suspicious IP Behavior

Scamalytics continuously monitors IP traffic to detect unusual activity patterns. Rapid location changes, high-volume requests, or irregular browsing behaviors raise alerts. By identifying these anomalies in real time, the system prevents scammers from progressing further. Early detection gives businesses a chance to block threats instantly. This proactive approach keeps fraud attempts from escalating.

Verifying IP Location Accuracy

The platform checks whether the physical location of an IP matches the user’s claimed address. Fraudsters often mask their locations using VPNs, proxies, or Tor nodes. A mismatch increases the IP’s risk score, triggering further investigation. This ensures suspicious users are flagged without affecting genuine customers. Accurate location verification forms a core part of scam prevention.

Monitoring Connection Types

Scamalytics identifies whether a connection is from a residential, mobile, or data center network. Fraudsters frequently use anonymized networks to avoid detection. By recognizing these patterns, the system can highlight risky connections. Businesses can choose to block or further verify such users. This extra layer of monitoring strengthens security measures.

Risk Scoring for Scam Prevention

Assigning Fraud Risk Scores

Every IP is analyzed and given a fraud risk score based on multiple factors. A high score means the user is more likely to engage in fraudulent activity. Businesses can set thresholds to block or review high-risk users. This scoring system allows targeted prevention without impacting normal users. It helps prioritize the most urgent threats for action.

Using Machine Learning for Accuracy

Machine learning allows Scamalytics to adapt to new scam techniques. It studies past scam attempts and successful detections to refine its algorithms. This continuous learning ensures the platform stays effective even as scammers evolve. The result is a system that gets smarter over time. It improves detection without increasing false positives.

Automating Decisions in Business Systems

Scamalytics risk scores can be integrated directly into business platforms. Automated workflows can block, verify, or approve users based on score thresholds. This reduces manual work while maintaining strong security. Businesses can customize responses to suit their operations. Automation ensures scams are stopped without delaying legitimate users.

Global Scam Blacklist

Accessing a Shared Fraud Database

Scamalytics maintains a global blacklist of known scam-related IP addresses. This list is compiled from multiple industries and shared among users. If a flagged IP tries to connect, it’s instantly recognized as a threat. Sharing this data helps all members benefit from each other’s detections. It reduces the chance of scams going undetected.

Updating Blacklists Instantly

The blacklist is updated in real time whenever new threats are detected. This means businesses using Scamalytics are always protected against the latest scams. Instant updates prevent fraudsters from reusing IPs across multiple targets. It ensures defences remain relevant in fast-changing scam environments. Real-time data sharing strengthens the global prevention network.

Avoiding False Scam Flags

Blocking genuine users by mistake can harm trust and revenue. Scamalytics works to reduce false positives by refining its detection rules. It balances security with user experience, ensuring only truly risky IPs are flagged. This careful approach makes scam prevention more accurate. It allows businesses to protect themselves without alienating customers.

Multi-Layer Scam Prevention

Combining IP Data with Behavioral Analysis

Scamalytics doesn’t rely solely on IP checks; it also examines user behavior. This includes login times, interaction patterns, and messaging activity. Fraudsters may hide their IP, but suspicious actions can still expose them. Combining both data types creates a stronger defence. It helps detect scams that single-layer systems might miss.

Detecting Scams Across Industries

Different industries face different types of scams. Scamalytics is flexible enough to handle varied threats, from fake transactions in e-commerce to romance scams in dating platforms. Its adaptable system works with each sector’s unique challenges. This versatility makes it valuable for diverse businesses. It ensures targeted protection for every use case.

Offering API-Based Integration

Businesses can integrate Scamalytics into their existing systems via API. This allows fraud checks to run automatically during sign-ups, logins, or purchases. API integration ensures scam prevention happens in real time without manual effort. It keeps security seamless for both businesses and customers. This automation speeds up decision-making while maintaining safety.

Industry-Specific Scam Protection

E-Commerce Scam Prevention

E-commerce sites are frequent targets for payment fraud and fake orders. Scamalytics identifies risky buyers before transactions are completed. This reduces chargebacks and lost revenue. By blocking fraudulent activity early, businesses maintain healthier profit margins. It also improves trust among genuine customers.

Banking and Financial Security

Banks and fintech companies face phishing, account takeover, and identity theft scams. Scamalytics analyzes login attempts and transaction requests for suspicious patterns. It blocks high-risk users before they can exploit systems. This reduces fraud losses while keeping compliance in check. Financial institutions benefit from lower operational risk.

Dating and Social Platform Safety

Dating platforms are prime targets for romance scams and fake profiles. Scamalytics detects these by analyzing IPs, user messages, and behavioral patterns. This keeps communities safe and trustworthy. Removing scammers improves user satisfaction and retention. It also protects the platform’s reputation from fraud-related complaints.

Community-Based Scam Reporting

Accepting User-Submitted Scam Reports

Scamalytics allows its users to report suspected scammers. These reports feed into the shared fraud database. This collective effort helps identify threats that automated systems might miss. It gives the platform access to unique real-world scam data. Community reporting adds a human layer to detection.

Strengthening Detection with Crowd Data

By combining human reports with machine analysis, Scamalytics creates a broader scam detection net. Crowd data often reveals niche or emerging scam tactics. This information is valuable for improving detection algorithms. It ensures the platform stays relevant against evolving threats. The blend of human and AI intelligence makes prevention more reliable.

Building a Safer Online Environment

The ultimate goal of Scamalytics is to make the internet safer. By blocking scammers and sharing intelligence, it discourages fraudulent activity. Businesses benefit from stronger customer trust and fewer disputes. Users enjoy secure online interactions without extra hassle. This shared mission strengthens the global fight against scams.

The Role of Scamalytics in Future Scam Prevention

Adapting to Evolving Scam Methods

Scammers are constantly updating their tactics to bypass security systems. Scamalytics responds by updating detection models and blacklists. Machine learning helps the system adapt faster than manual processes. This agility is essential in today’s fast-changing threat landscape. It ensures businesses remain one step ahead of fraudsters.

Expanding Global Data Partnerships

The more businesses share fraud data, the stronger scam prevention becomes. Scamalytics continues to grow its network of participating companies. This global collaboration increases the volume and accuracy of threat intelligence. It creates a united front against online scams. The result is a more secure digital ecosystem.

Supporting Compliance and Regulations

Industries like finance and e-commerce must comply with anti-fraud regulations. Scamalytics helps by providing detailed risk analysis and prevention tools. This not only reduces fraud but also supports regulatory requirements. Businesses stay compliant while maintaining efficient operations. It offers both protection and peace of mind.

Conclusion

Scamalytics can effectively prevent online scams through its combination of real-time monitoring, risk scoring, global blacklists, machine learning, and community reporting. Its adaptable approach works across industries, targeting specific scam types with precision. By blending automation with human intelligence, it provides a future-ready defence against evolving threats. Businesses using Scamalytics gain stronger protection, reduced fraud losses, and improved trust from their customers.