Autodoc, Europe’s leading online car parts retailer, is gearing up for an IPO that could value the company at $2.8 billion. Already a dominant e-commerce force in automotive spare parts, the company aims to leverage its scale and tech infrastructure to appeal to global investors. With a focus on expanding market share and operational efficiency, Autodoc is positioning itself as a high-growth player in a fragmented industry.

European Car Parts Market: Autodoc’s Playground

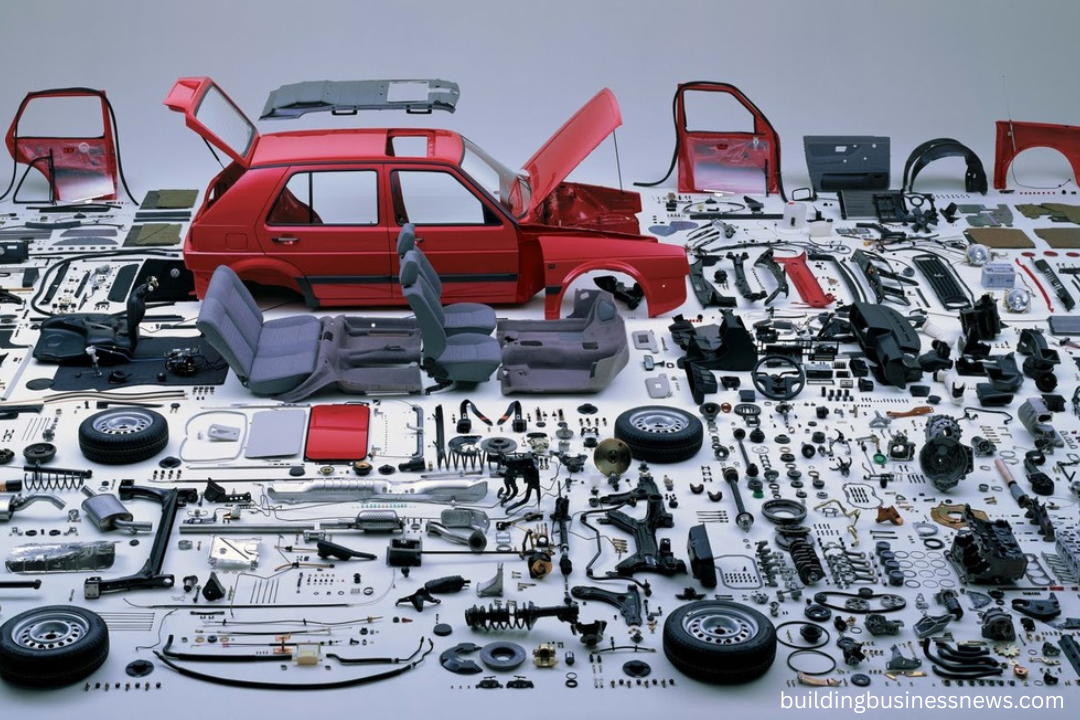

The European aftermarket for car parts is worth over €100 billion annually, with thousands of small retailers and garage parts suppliers. Autodoc has disrupted this landscape by offering a user-friendly online platform, competitive pricing, and fast delivery. By focusing on quality items—from brake pads to engine filters—the company has built a loyal customer base. The IPO is meant to accelerate this growth and fund expansion across Europe and beyond.

Technology and Logistics: Autodoc’s Competitive Edge

Autodoc has invested heavily in internal technology, a seamless user experience, and an efficient warehousing model. Its advanced warehouse management ensures high stock accuracy and same-day shipping in many regions. The company also utilizes data analytics to predict demand patterns, thereby reducing overstocking and enhancing profitability. These capabilities are central to Autodoc’s value proposition for investors ahead of the IPO.

Financial Performance Driving IPO Valuation

In its most recent fiscal year, Autodoc reported strong revenue growth—exceeding 40% year-over-year—and improved gross margins, driven by cost control and volume leverage. EBITDA margins have begun turning positive, a key indicator that the business is scalable and nearing profitability. These financials underpin the forecasted $2.8 billion valuation, with investors viewing Autodoc as a rare, high-growth, high-margin tech-enabled retailer in Europe.

Market Expansion Post-IPO

Proceeds from the IPO will support geographic expansion into markets like Eastern Europe, the U.S., and parts of Asia. The goal is to replicate success in new regions by localizing supply, building regional fulfillment centers, and partnering with auto mechanics to extend reach. Autodoc’s expansion plans include scaling marketing and publishing localized websites in multiple languages to capture both DIY enthusiasts and professional garages.

Competitive Landscape and Autodoc’s Positioning

Autodoc competes with traditional brick-and-mortar suppliers, e-commerce giants like Amazon, and niche auto parts platforms. Its advantage lies in automotive specialization, deep product catalog, and customer support tailored to technical buyers. The IPO provides Autodoc with the fuel to further differentiate itself through faster delivery, exclusive OEM partnerships, and advanced product search tools.

Risks and Considerations for Autodoc Investors

Despite its strengths, Autodoc faces pressure from competition, macroeconomic risks (such as automotive downturns), and rising logistics costs. E-commerce margins can be volatile, and protecting the business from new entrants will require continuous tech investment. The success of Autodoc’s IPO hinges on demonstrating durable profitability and effective use of fresh capital post-listing.

Sustainability and ESG Focus

Sustainability is a growing focus for investors, and Autodoc is responding with eco-friendly packaging, carbon-neutral shipping options, and green product lines. The inclusion of ESG practices in its corporate strategy helps Autodoc stand out to institutional investors and broadens its appeal during the initial public offering (IPO) process.

Timeline and Road to Market

Autodoc is expected to launch roadshows in Q4, with the goal of listing in early 2026. Underwriters, financial advisors, and legal teams are finalizing prospectus materials and regulatory filings. Pricing details will depend on investor feedback during this process, and the final valuation could exceed or slightly dip from the projected $2.8 billion.

Analyst Outlook on Autodoc’s Growth Potential

Analysts see Autodoc as one of the few pure-play, high-growth e-commerce firms in Europe with near-term profitability. At a $2.8 billion valuation and projected annual revenue of over €1 billion in a few years, forward multiples could approach 6–8 times EV/Revenues. If growth sustains, Autodoc may trade near tech stock valuations, signaling investor confidence.

Autodoc’s Vision Beyond Spare Parts

In the longer term, Autodoc aims to evolve into a comprehensive vehicle aftermarket platform, offering repair services, diagnostic tools, and predictive maintenance through IoT. Backed by IPO funds, the company plans to integrate more tech services, making Autodoc a central player in connected car ecosystems and sustainability initiatives.

Frequently Asked Questions (FAQ’s)

What is Autodoc?

Autodoc is a leading European online retailer specializing in automotive spare parts and accessories. It serves both DIY car owners and professional garages.

When is Autodoc planning its IPO?

Autodoc is expected to go public in early 2026, with pre-IPO activities, including investor roadshows and filings, commencing in late 2025.

What is Autodoc expected to be valued at during its IPO?

The company aims for a valuation of approximately $2.8 billion upon its IPO launch.

What will Autodoc use the IPO proceeds for?

IPO proceeds will support Autodoc’s international expansion, logistics infrastructure, and technological innovation, including the development of new platforms and tools.

What markets does Autodoc currently operate in?

Autodoc currently operates across Europe, including Germany, France, Spain, and Italy, and is planning to expand into the U.S., Eastern Europe, and Asia.

How does Autodoc differ from traditional car parts retailers?

Unlike brick-and-mortar stores, Autodoc offers a digital-first experience with a massive inventory, user-friendly interface, and fast delivery services.

Is Autodoc profitable?

Autodoc is approaching profitability, driven by strong revenue growth and improved margins, making it an attractive investment ahead of its IPO.

What are the risks of investing in Autodoc?

Key risks include competition, logistics cost volatility, macroeconomic factors affecting the auto industry, and the need to maintain technological leadership.

Conclusion

Autodoc’s pursuit of a $2.8 billion valuation through its IPO signals investor appetite for scalable, tech-enabled European retail disruptors. With strong revenue growth, improving margins, and ambitious international expansion, Autodoc is well-positioned for success. The success of this IPO will depend on how well the company convinces the market of its scalability, profitability roadmap, and strategic use of capital.